tax service fee closing cost

Tax service fees exist since. Youll get full-service support for pre-negotiated listing fees of just 1 or 3000 saving you thousands when you sell.

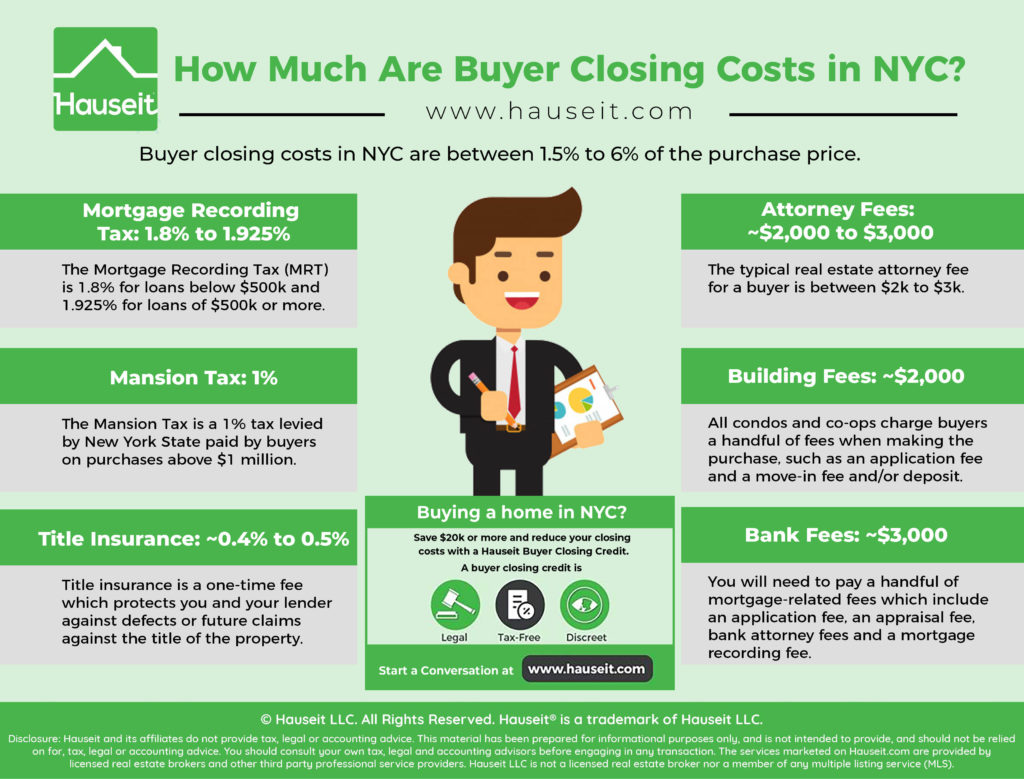

How Much Are Buyer Closing Costs In Nyc Hauseit

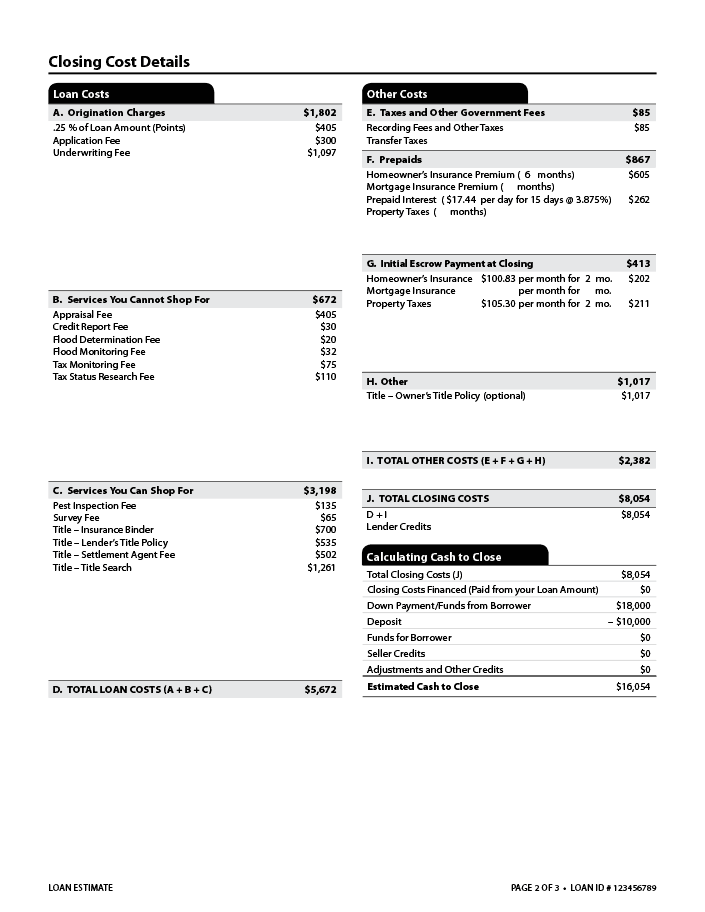

A tax service fee typically around 50 is collected and paid to an outside.

. Sunday October 2 2022. According to the National Society of Accountants the average fee in 2020 for preparing Form 1040 with Schedule A to itemize personal deductions. A tax service fee is paid by mortgage borrowers to mortgage lenders to ensure that a mortgaged propertys property taxes are paid on time.

Closing costs are based on your loan type loan amount lender and geographical area. A tax service fee is a legitimate closing cost that is assessed and collected by a lender to ensure that mortgagors pay their property taxes on time. Paying your online tax preparer through your refund could cost you up to 40 extra.

Its usually between 75 and 125. Flood certification is a mandatory mortgage step in certain locations and is included as part of the closing costs as an additional 15-25 fee according to LendingTree. 2500 1 of loan amount.

According to the National Society of Accountants 20182019 Income and Fees Survey the average tax preparation fee for a tax professional to prepare a Form 1040 and. HR Block and TurboTax each charge an additional processing fee of 40 if you agree. Whether youre a retail correspondent or wholesale lender ClosingCorp.

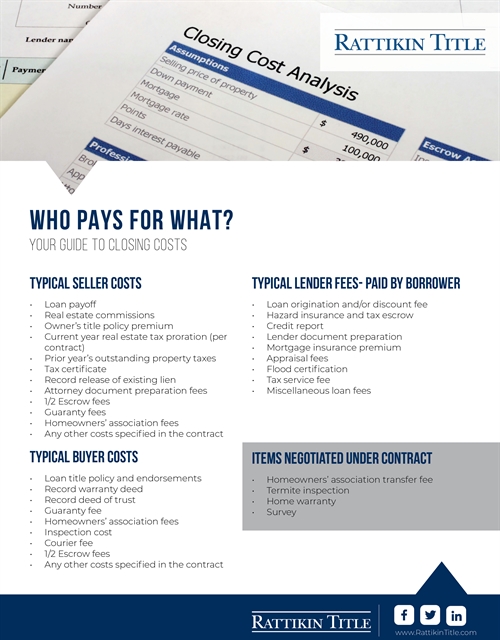

This is a very negotiable item. This credit isnt free either. Before we dive into specific QA most of your mortgage closing costs can be broken down into 5 categories.

Closing Date Unexempt property. What are tax service fees. Unlike other solutions ClosingCorp Fees produces accurate actual data NOT estimates in less than a minute.

Processing Fee VA - add 400. Tax service fees exist. This calculator is meant for.

The lender may also offer to give you a credit to help with your closing costs. A fee typically 20-25 is paid to the credit service agency to obtain the report. Underwriting Fee VA - add 225.

Tax Service Fee FHA VA - add 115. Tax service fees are closing costs that are assessed and collected by a lender as a means of making sure that mortgage holders pay property taxes in a timely manner. Document Preparation Fee - The cost of preparing loan documents for the closing.

Buyers and sellers also usually split the settlement or. Your costs will likely look different. A tax service fee is a genuine closing cost that is assessed and collected by a lender to guarantee that mortgagors pay their property taxes on time.

Typically the lender will either increase your loan amount to cover.

/dotdash-111214-buying-home-cash-vs-mortgage-v2-325bbfe3ca7343ca904ecaa9d2cb6c67.jpg)

Buying A House With Cash Vs Getting A Mortgage

The Scoop Blog By Changemyrate Com Refinance Or Apply For A Mortgage Online Read Amazing Insights Into Family Home And Life

Mortgage Closing Costs 101 Arizona Real Estate

Massachusetts What Are Closing Costs And How Much Are They

Guide To Closing Costs And Taxes Hero Home Programs

Closing Cost Who Pays What In Phoenix Arizona Phoenix Az Real Estate And Homes For Sale

Loan Estimate Explainer Consumer Financial Protection Bureau

Closings Costs For A Home In Somerville R Boston

Itemized Fee Worksheet Encompass News And Service Portal Fill Out Sign Online Dochub

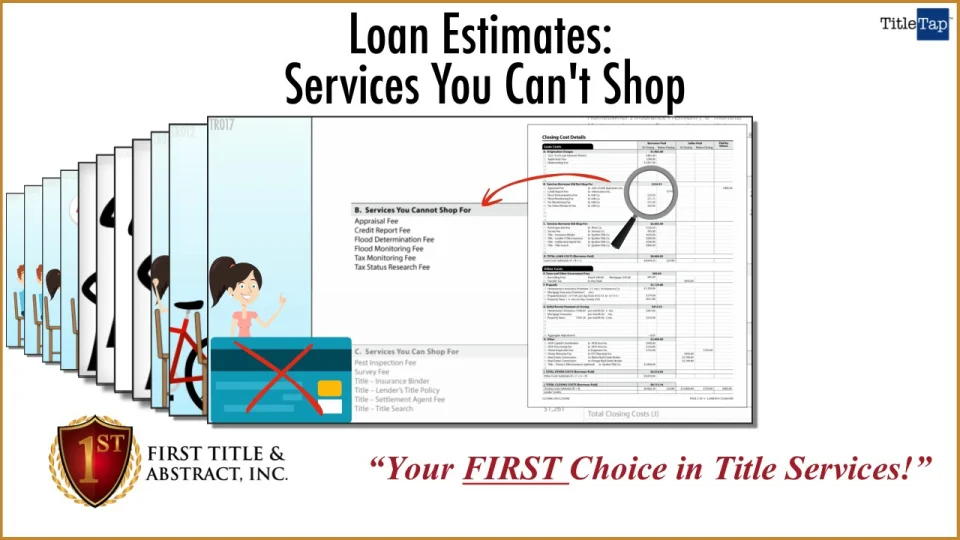

Understanding Your Loan Estimate Services You Cannot Shop For Naples Title Company Marco Island Title Company First Title Abstract Inc

Penfed Mortgage Page 2 Myfico Forums 6120287

Closing Costs Associated With Real Estate Cash Offers Accept Inc

How To Estimate Closing Costs Assurance Financial

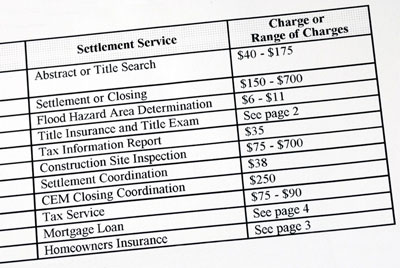

Settlement Costs What Are Closing Costs Hire Realty Llc

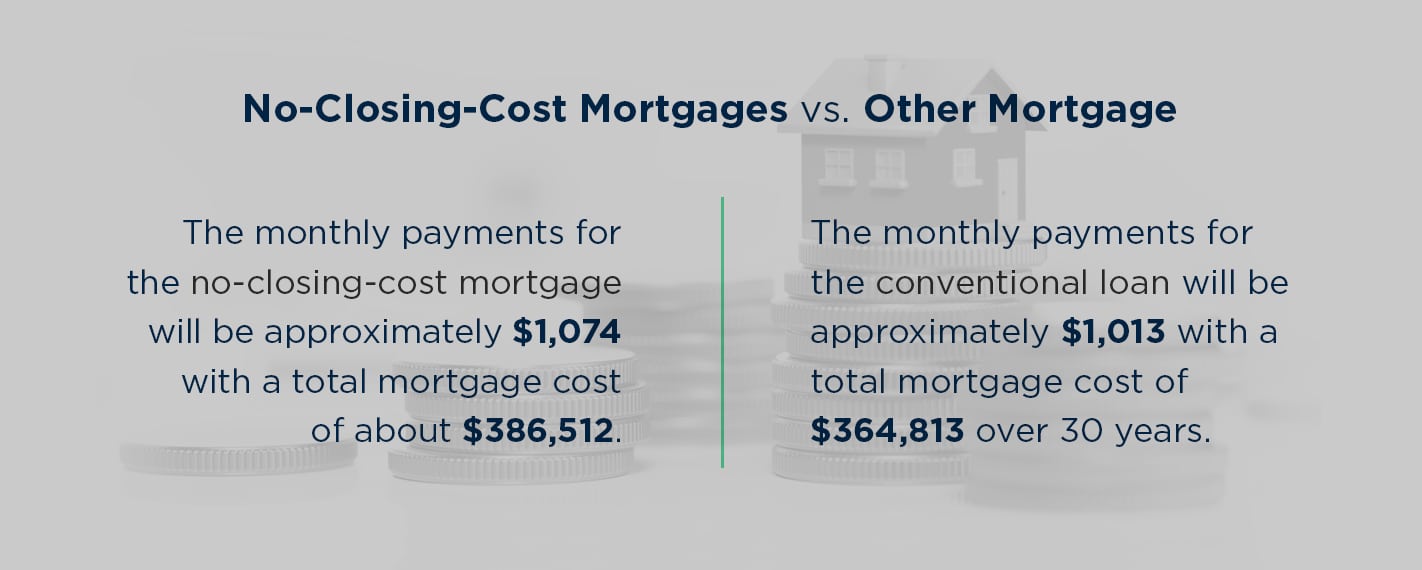

Can You Roll Closing Costs Into A Mortgage The Money Boy

Closing Costs For Home Sellers Bankrate

Buyer Closing Costs Explained The Arlington Expert

Who Pays Closing Costs Including Title Insurance Ohio Real Title